Situation normale

DIPA GROUP

SRL

2830

Willebroek

Since

01/09/2011

BE0840283977

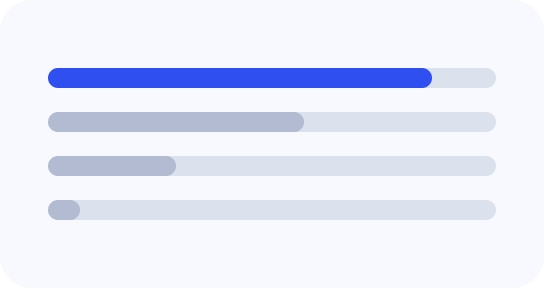

Financial Health Indicator

7

Equity

€84.5K

+14%

YoY

Gross Operating Margin

€67.6K

-35%

YoY

EBITDA

€66.9K

-35%

YoY

Gain/Loss

€10.1K

-69%

YoY

DIPA GROUP’s business network visualized

Explore our interactive spiderweb to visually navigate DIPA GROUP’s entire network of mandates and participations. Get insights into both current and historical connections.

DIPA GROUP

-

robby VAN ASCH2830 WillebroekSince 2011

-

Robby Emiel J Van Asch2830 WillebroekSince 2011

Detailed insights into DIPA GROUP’s financial history

See financial trends including, equity, operating income, profit/loss and employees of DIPA GROUP. Compare KPI’s against similar companies. Explore financial ratios, annual accounts and much more.

| 2024 | 2023 | 2022 | 2021 | 2020 | |

|---|---|---|---|---|---|

|

Equity

|

84.5K

|

74.4K

|

88.9K

|

97.4K

|

82.8K

|

|

Gross Operating Margin

|

67.6K

|

103.4K

|

62.5K

|

65.3K

|

55.9K

|

|

Gain/Loss

|

10.1K

|

32.7K

|

10.6K

|

15.4K

|

2.1K

|

Find similar companies like DIPA GROUP

Find more companies with similar activities to DIPA GROUP from our extensive database.

-

De Cronos Groep SA2550 KontichSince 1999

De Cronos Groep SA2550 KontichSince 1999 -

Deloitte Consulting & Advisory SRL1930 ZaventemSince 2001

-

SPARAXIS SA4000 LiègeSince 1994

-

Deloitte Accountancy, Tax & Legal Services SRL1930 ZaventemSince 1991

-

NOSHAQ PARTNERS SRL4000 LiègeSince 2008

-

Ecole Decroly - L'Ermitage ASBL1180 UccleSince 1934

-

FEDERATIE VAN DE ONTVANGERS DER REGISTRATIE ASBL1000 BruxellesSince 2005

-

Participatiemaatschappij Vlaanderen SA1000 BruxellesSince 1995

Participatiemaatschappij Vlaanderen SA1000 BruxellesSince 1995 -

VOKA - Kamer van Koophandel West-Vlaanderen ASBL8500 KortrijkSince 1986

VOKA - Kamer van Koophandel West-Vlaanderen ASBL8500 KortrijkSince 1986 -

STORM MANAGEMENT SA2600 AntwerpenSince 2008

STORM MANAGEMENT SA2600 AntwerpenSince 2008

Frequently asked questions about DIPA GROUP

-

Where is DIPA GROUP located?

DIPA GROUP’s headquarters is located in Hamerdijk 4 , 2830 Willebroek. -

Who are the directors of DIPA GROUP?

DIPA GROUP’s directors include- robby VAN ASCH

- Robby Emiel J Van Asch

-

When was DIPA GROUP founded?

DIPA GROUP was founded in 2011-09-01. DIPA GROUP has been active for 14 years. -

What are DIPA GROUP’s NACEBEL codes?

DIPA GROUP’s NACEBEL codes are- 41001 Construction générale de bâtiments résidentiels (2025)

- 56210 Activités de traiteur événementiel (2025)

- 41201 Construction générale de bâtiments résidentiels (2008)

- 56210 Services des traiteurs (2008)

-

What is DIPA GROUP’s VAT number?

DIPA GROUP’s VAT number is BE0840283977. -

What is DIPA GROUP’s juridical form?

DIPA GROUP’s juridical type is Société à responsabilité limitée (SRL). -

How is the financial situation of DIPA GROUP?

openthebox has estimated that DIPA GROUP’s financial health score to be 7/10.