Situation normale

LUNCH KOREA

SRL

1930

Zaventem

Since

29/10/2018

BE0712669193

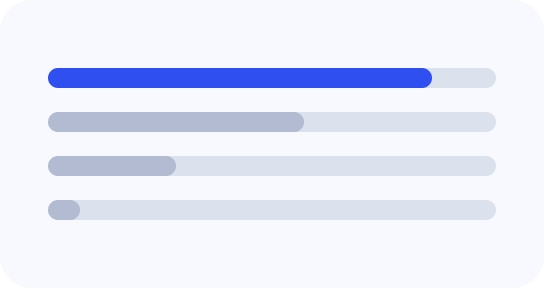

Financial Health Indicator

8

Equity

€18.3K

Gross Operating Margin

€39.7K

+236%

YoY

EBITDA

€38.9K

+531%

YoY

Gain/Loss

€35.6K

+1073%

YoY

LUNCH KOREA’s business network visualized

Explore our interactive spiderweb to visually navigate LUNCH KOREA’s entire network of mandates and participations. Get insights into both current and historical connections.

LUNCH KOREA

-

Kwang CHOI

-

Kwang Joen CHOI1160 Auderghem/OudergemSince 2020

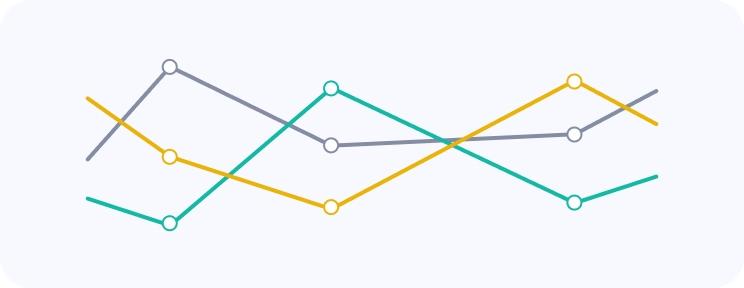

Detailed insights into LUNCH KOREA’s financial history

See financial trends including, equity, operating income, profit/loss and employees of LUNCH KOREA. Compare KPI’s against similar companies. Explore financial ratios, annual accounts and much more.

| 2023 | 2022 | 2021 | 2019 | |

|---|---|---|---|---|

|

Equity

|

18.3K

|

-17.2K

|

-20.2K

|

-10.0K

|

|

Gross Operating Margin

|

39.7K

|

11.8K

|

213.8

|

-8.8K

|

|

Gain/Loss

|

35.6K

|

3.0K

|

-4.0K

|

-28.6K

|

|

Employees

|

|

0.2

|

|

|

Find similar companies like LUNCH KOREA

Find more companies with similar activities to LUNCH KOREA from our extensive database.

-

De Cronos Groep SA2550 KontichSince 1999

-

Deloitte Consulting & Advisory SRL1930 ZaventemSince 2001

-

SPARAXIS SA4000 LiègeSince 1994

-

Ecole Decroly - L'Ermitage ASBL1180 UkkelSince 1934

-

NOSHAQ PARTNERS SRL4000 LiègeSince 2008

-

VOKA - Kamer van Koophandel Antwerpen - Waasland vzw ASBL2000 AntwerpenSince 1969

-

FEDERATIE VAN DE ONTVANGERS DER REGISTRATIE ASBL1000 BruxellesSince 2005

-

Deloitte Belastingconsulenten/Conseils Fiscaux SRL1930 ZaventemSince 1978

-

Participatiemaatschappij Vlaanderen SA1000 BrusselSince 1995

-

VOKA - Kamer van Koophandel West-Vlaanderen ASBL8500 KortrijkSince 1986

Frequently asked questions about LUNCH KOREA

-

What is LUNCH KOREA’s official website?

LUNCH KOREA’s official website is https://www.randstad.com/jobs/belgium/vlaams-brabant/zaventem. -

Where is LUNCH KOREA located?

LUNCH KOREA’s headquarters is located in Stationsstraat 95 , 1930 Zaventem. -

What are the primary activities of LUNCH KOREA?

LUNCH KOREA’s primary activities include: recherche d'emploi, zaventem. -

Who are the directors of LUNCH KOREA?

LUNCH KOREA’s directors include- Kwang CHOI

- Kwang Joen CHOI

-

When was LUNCH KOREA founded?

LUNCH KOREA was founded in 2018-10-29. LUNCH KOREA has been active for 6 years. -

What are LUNCH KOREA’s NACEBEL codes?

LUNCH KOREA’s NACEBEL codes are- 56101 Restauration à service complet (2008)

- 56210 Services des traiteurs (2008)

-

What is LUNCH KOREA’s VAT number?

LUNCH KOREA’s VAT number is BE0712669193. -

What is LUNCH KOREA’s juridical form?

LUNCH KOREA’s juridical type is Société à responsabilité limitée (SRL). -

How is the financial situation of LUNCH KOREA?

openthebox has estimated that LUNCH KOREA’s financial health score to be 8/10.