Situation normale

SUITS & CASUAL

SA

8500

Kortrijk

Since

12/07/1999

BE0466516055

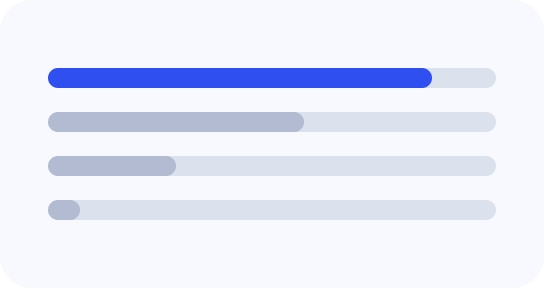

Financial Health Indicator

9

Equity

€639.7K

+13%

YoY

Gross Operating Margin

€160.6K

+73%

YoY

EBITDA

€156.9K

+108%

YoY

Gain/Loss

€74.8K

+582%

YoY

SUITS & CASUAL’s business network visualized

Explore our interactive spiderweb to visually navigate SUITS & CASUAL’s entire network of mandates and participations. Get insights into both current and historical connections.

SUITS & CASUAL

-

Tom VAN POUCKE8500 KortrijkSince 2003

-

Reinhold Schepers8501 KortrijkSince 2016

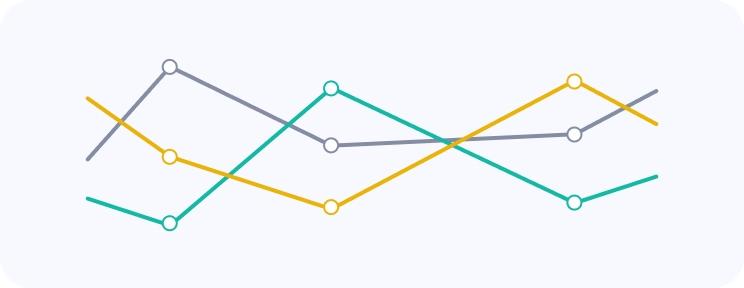

Detailed insights into SUITS & CASUAL’s financial history

See financial trends including, equity, operating income, profit/loss and employees of SUITS & CASUAL. Compare KPI’s against similar companies. Explore financial ratios, annual accounts and much more.

| 2024 | 2023 | 2022 | 2021 | 2020 | |

|---|---|---|---|---|---|

|

Equity

|

639.7K

|

564.9K

|

553.9K

|

401.4K

|

325.5K

|

|

Gross Operating Margin

|

160.6K

|

92.9K

|

228.4K

|

98.7K

|

86.8K

|

|

Gain/Loss

|

74.8K

|

11.0K

|

152.5K

|

75.9K

|

-341.0K

|

|

Employees

|

|

|

|

|

0.7

|

Find similar companies like SUITS & CASUAL

Find more companies with similar activities to SUITS & CASUAL from our extensive database.

-

De Cronos Groep SA2550 KontichSince 1999

De Cronos Groep SA2550 KontichSince 1999 -

Deloitte Consulting & Advisory SRL1930 ZaventemSince 2001

-

SPARAXIS SA4000 LiègeSince 1994

-

Deloitte Accountancy, Tax & Legal Services SRL1930 ZaventemSince 1991

-

NOSHAQ PARTNERS SRL4000 LiègeSince 2008

-

Ecole Decroly - L'Ermitage ASBL1180 UccleSince 1934

-

FEDERATIE VAN DE ONTVANGERS DER REGISTRATIE ASBL1000 BruxellesSince 2005

-

Participatiemaatschappij Vlaanderen SA1000 BruxellesSince 1995

Participatiemaatschappij Vlaanderen SA1000 BruxellesSince 1995 -

VOKA - Kamer van Koophandel West-Vlaanderen ASBL8500 KortrijkSince 1986

VOKA - Kamer van Koophandel West-Vlaanderen ASBL8500 KortrijkSince 1986 -

STORM MANAGEMENT SA2600 AntwerpenSince 2008

STORM MANAGEMENT SA2600 AntwerpenSince 2008

Frequently asked questions about SUITS & CASUAL

-

Where is SUITS & CASUAL located?

SUITS & CASUAL’s headquarters is located in Leiestraat 13 , 8500 Kortrijk. -

Who are the directors of SUITS & CASUAL?

SUITS & CASUAL’s directors include- Tom VAN POUCKE

- Reinhold Schepers

-

When was SUITS & CASUAL founded?

SUITS & CASUAL was founded in 1999-07-12. SUITS & CASUAL has been active for 26 years. -

What are SUITS & CASUAL’s NACEBEL codes?

SUITS & CASUAL’s NACEBEL codes are- 82990 Autres activités de service de soutien aux entreprises nca (2025)

- 82990 Autres activités de soutien aux entreprises n.c.a. (2008)

-

What is SUITS & CASUAL’s VAT number?

SUITS & CASUAL’s VAT number is BE0466516055. -

What is SUITS & CASUAL’s juridical form?

SUITS & CASUAL’s juridical type is Société anonyme (SA). -

How is the financial situation of SUITS & CASUAL?

openthebox has estimated that SUITS & CASUAL’s financial health score to be 9/10.